Understand the story before you launch your brand refresh

Irrational Agency

Irrational Agency

This post was actually written prior to Elon Musk's rebrand of Twitter to X. However, with tales emerging of Musk's apparent historic obsession with X as a brand name, and the reception of the refresh generally, the rebrand has thrown into sharp relief the role that market research can, and should, play in the branding process. In a serendipitous coincidence we recently finished a brand refresh research project with a global pharma client, that demonstrates how behavioural science can be a vital part in ensuring a refresh ultimately tells the right story for your brand.

In a brand refresh, traditional quantitative research is good for answering two things:

- Does this refresh cause our metrics to go through the roof?

- Or does it cause them to fall off a cliff?

The reality is that changes in perceptions can often be subtle, particularly in terms of the feelings and narratives the mnemonics evoke. Consequently, whilst research used in the above way is an effective ‘sense check’ to disaster-proof a decision, it relegates the role of insight to the very peripheries of the brand refresh journey.

It can also fail to pick out the nuanced differences between the assets, potentially creating incongruencies in what’s conveyed by branding and communications, or missing subtle opportunities to create exciting, unique positionings.

However, what if it was possible to tease out these differences?

Our approach to this problem is System 3.

System 3 builds a catalogue of the feelings, themes, ideas, and needs that consumers are thinking about when they see your brand. We then turn these into hugely detailed maps of associations between words, concepts, and brands – this offers a window into stories the brand asset(s) communicate and the narratives consumers tell themselves when they are making purchasing decisions.

We used exactly this approach when a pharma client recently approached us with a challenge around their brand refresh strategy. Having recently developed several new brand assets, and tested them with traditional methods, they had found that one asset unexpectedly stood out in qualitative research, and they wanted to tease out which told the better brand story and have the strongest impact on brand uptake and consideration.

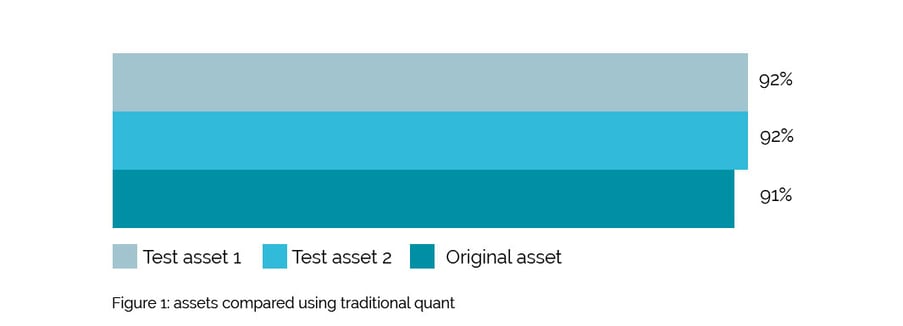

Using a traditional likelihood to purchase question, we can see the assets are very difficult to pull apart and a struggle to build on the original asset:

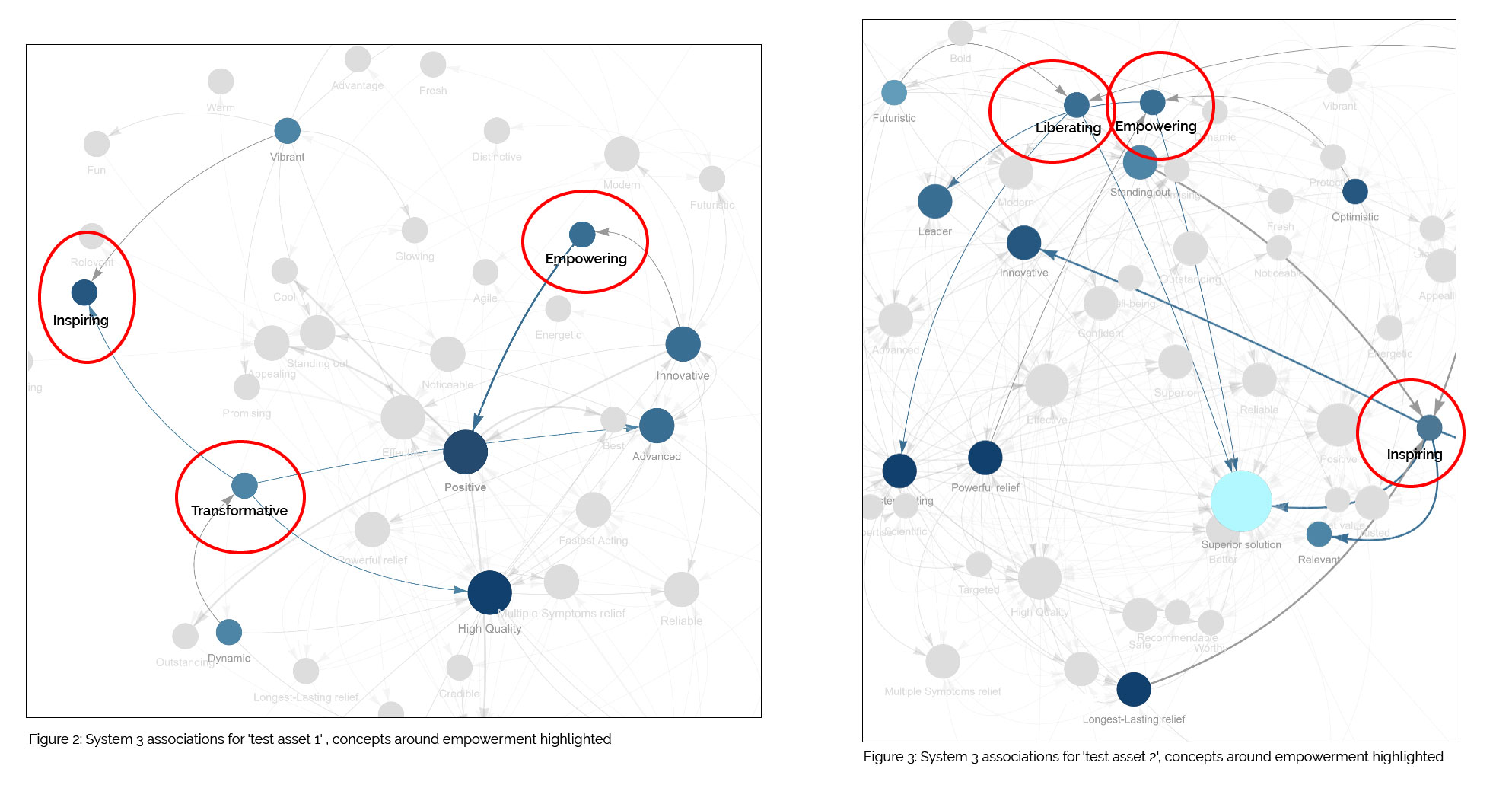

However, when we compare the assets in terms of the ideas and feelings they communicate, we see that they are much more distinct. Below you will see the keywords that consumers associate with the two assets. For this example, we’ve just highlighted words related to inspiration and empowerment and even in this small snippet, we see key differences emerging.

The first stand-out here is the existing asset is linked to the functional qualities of the product. In sectors like pharma and healthcare, where competitor products can be very similar in terms of ingredients and effects, distinctive brand assets that work together with the product can be invaluable in terms of sales. Therefore, there is an increasing need to stand for ‘more’ than efficacy or symptom relief, to convey a story and feeling consumers can connect with. In this study, the two potential assets went further by communicating a sense of empowerment – whilst both land this message, we see that test asset 1 is thought to be ‘transformative’, whilst test asset 2 is more aligned with being ‘liberating’.

Both of these are highly desirable brand positions to own, but whilst test asset 1’s transformation is connected to the quality of the product (which, again, links back to being functional), test asset 2’s is connected to being a leader – this could emerge as a feeling of self-determination, of being in control and in the driver’s seat again. As many consumers will seek out pharma products to treat something and ultimately get it under control, this is a message that connects seamlessly with the internal narratives consumers tell themselves.

And so, not only does System 3 show that both assets are a strong build on the original, but also that test asset 2 is likely to land stronger, more relevant messages with consumers. We know that richer narratives are more rewarding for consumers, being more distinct and staying with them for longer, which translates to clear commercial potential for getting this right. Whilst traditional quant suggested the assets performed identically, System 3 effectively cut through the noise, leading us to recommend test asset 2 as the one to take forward and challenged what they believed internally to be the winning option.

Taking these results together, they exhibit exactly why narrative research can be so much more powerful than traditional quant in maximising the value of your brand refresh. System 3 embeds insight as part of the creative process itself, a set of tools to use throughout the brand refresh journey. There are also many other ways of using System 3 too. Implementing it even earlier, for instance, can support brand owners in identifying the stories their current assets communicate, laddering down to the equities which are worth keeping and which you may want to avoid. It can then provide iterative feedback throughout the process, identifying the stories creatives can latch onto for inspiration during development.