FCA Consumer Duty: Your Roadmap for Consumer Testing

Irrational Agency

Irrational Agency

If you and your company need to respond to the new FCA Consumer Duty rules, here’s a straightforward roadmap to meet your obligations. Your board has to publish its plans by the end of October, we can help you meet that deadline.

The FCA regularly reviews and updates its rules to encourage better outcomes for the consumers of financial products. Over the last nine years the regulator has developed its understanding of behavioural economics, including conducting many of its own behavioural experiments and publishing several papers.

The FCA’s new Consumer Duty regulations introduce a new principle that must now be followed: Firms must act to deliver good outcomes for retail customers. This goes beyond previous principles which focused on fairness and clarity. Now, firms must have regard not just to their own actions but to the outcomes that follow.

For the first time, the new regulations require financial firms to explicitly use a behavioural economics lens to test their products and customer communications. Specifically, section 4.8 of the guidance requires firms to have:

- focus on the outcomes customers get, and act in a way that reflects how consumers actually behave and transact in the real world

- sufficient understanding of customer behaviour and how products and services function

While section 4.22 states:

- Firms must understand and take account of behavioural biases and the impact characteristics of vulnerability can have on consumer needs and decisions

This is an important move forward for regulation in the UK, and we believe it will encourage a positive change in the financial sector: a shift from using behavioural economics for extracting value, to adding value.

What You Have to Do Next

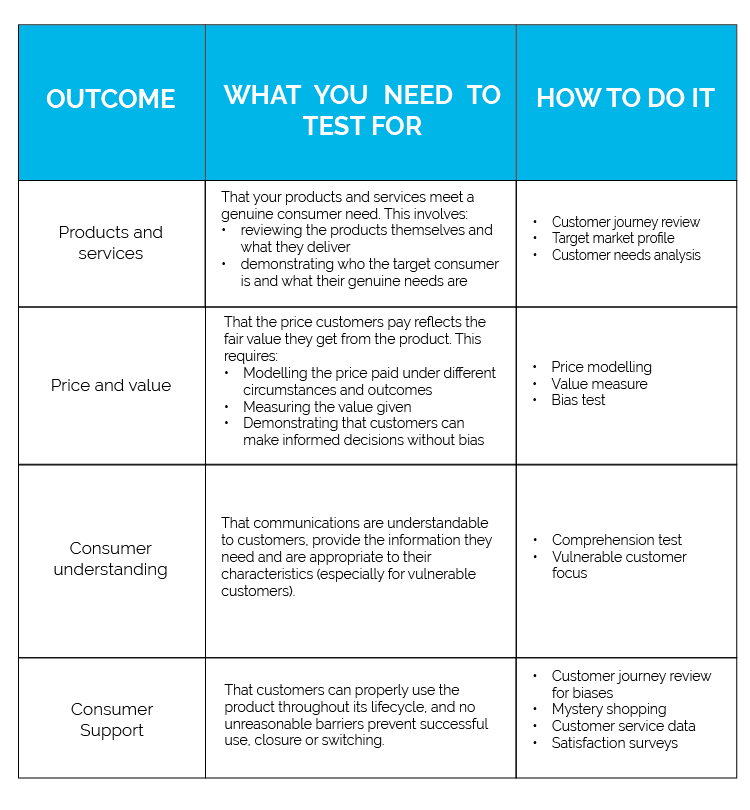

Providers and distributors of financial products must review and test what they do, to prove that customers are getting four positive outcomes:

- Products and services that meet a genuine customer need

- Prices that are clear, reasonable, and offer fair value

- Consumers must understand what they are buying or agreeing to

- Consumers must be supported through the lifecycle of the product to ensure they get the benefits of the products they have bought

The FCA specifically mentions behavioural biases throughout the guidance. It’s not enough just to show that you aren’t deliberately exploiting these biases. You must go further, to ensure that you help overcome customers’ existing biases that could lead them to make the wrong decisions.

Each of these criteria brings its own challenges.

The product outcome talks about genuine customer needs. But what are your customers’ true needs? Even their wants and desires are not necessarily easy to define. A behavioural approach can uncover not just what people say they want, but the underlying needs that sit behind it.

The price and value outcome requires pricing to be transparent, and to reflect the value offered by a product. But what is that value? Measuring it is no easy task.

Consumer understanding asks you to measure whether customers understand what you have told them. This means translating the information into a simpler format in order to ask questions about what they think they have seen. But if you can translate into a simpler version, why not use the simpler version in the first place?

And the customer support outcome challenges you to test how all parts of your organisation are serving customers, which could require you to run all three of the other tests multiple times through a product lifecycle.

Delivering these tests accurately, to satisfy the FCA’s standards, and manage the potential time and budgetary demands, requires a careful and informed behavioural research approach.

The table below shows some examples of behavioural and related informational risks that might potentially be regarded as a breach of consumer duty.

How can you review and test your products and communications?

Every firm must demonstrate to the FCA that it has tested all products it makes or sells, and all important communications, to ensure all four outcomes. The degree of testing and evidence expected depends on the size of the firm and its role in the distribution chain. Our suggested approach is:

Sometimes, more than one of these tests can be delivered through a single methodology, for example in-depth customer interviews or online simulation testing.

Sometimes, more than one of these tests can be delivered through a single methodology, for example in-depth customer interviews or online simulation testing.

After the initial all-product review, a process should be put in place to ensure outcomes continue to be met. This will involve reviewing new or modified products, and new or significantly changed communications, to confirm that they deliver the above outcomes. It would also involve ongoing monitoring of outcomes to identify any risks or shortfalls not discovered in the up-front reviews.

To deliver that ongoing review process, you can retain a behavioural research firm, or invest in your own in-house behavioural insight department as Barclays and ING have done.

Learn more in our full Guide to Consumer Duty testing – including a template research plan that you can customize, for your board to sign off by the October deadline. Download the guide here.